| Rates | How We Do It | Client Resources | Client Portal Login | Forms | Submit Claim Online | Contact Info |

| Rates |

ADDITIONAL INFORMATION:

How to Submit a Claim There are a few ways to place an account for collection:

INFORMATION TO PROVIDE

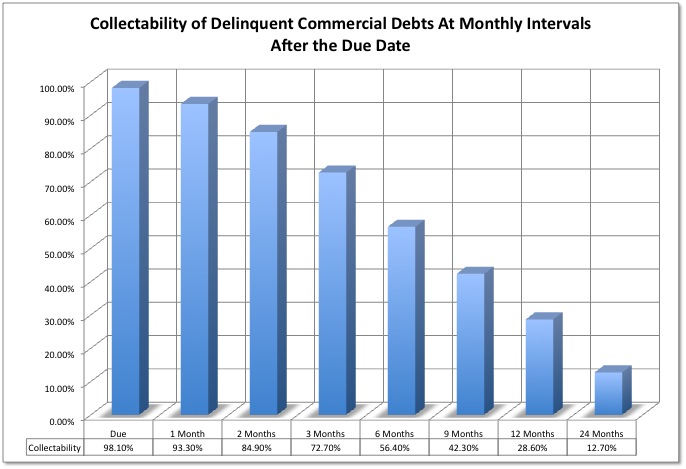

The Potential Cost of Waiting Sound credit practices are vital to all businesses. The deliquency of accounts receivable can cut sharply into your company's cash flow and profits. Profits are the ultimate picture of any company. We firmly believe the data contained in the below graph, supplied to us by the Commercial Law League of America, could prove to be beneficial in the decision making process regarding placement of delinquent accounts for outsourcing or collections. The information was compiled by the members of the Commercial Collection Agency Section of the Commercial Law League of America.

* For some industries, the due date may be several months after the delivery date This graph supports our recommendation of placing accounts for collection as early as possible, resulting in a higher recovery rate of dollars as the primary benefit.

|